If you ask realtors®, they’ll tell you that the spring real estate market in Niagara has been characterized by a bit of everything. It’s been slow at times, robust in places and just downright surprising at other times.

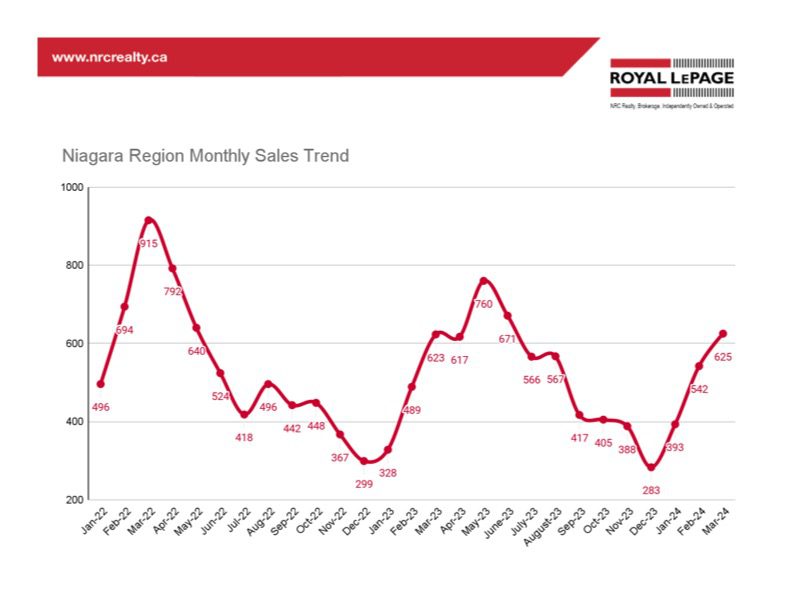

For example, the Niagara Association of Realtors® (NAR) reported just 465 home sales in March, 2024 – that’s the lowest number of sales in any March in at least 15 years. Despite the sluggishness, the prices of those homes hit an average of $669,000, up markedly from one year earlier (6.19 per cent) and there were more sales of all types of homes in March than in February.

Contributing to low sales are a couple of structural changes we are seeing in the market as well. For instance, some people are moving out of their existing homes either due to upsizing or relocation, but then rather than selling, they’re hanging on to their previous home as an investment property and lowering the number of available properties. Furthermore, far fewer people are upsizing in today’s higher interest rate environment, which means they are not buying a home nor selling their existing home, also leading to a decline in sales and active listings.

When it comes to prices, it does appear that most Sellers have realized that they may have to let go of their hopes for a repeat of 2022′s zaniness. At the same time, Buyers have been shocked to discover that they may have to make more than a rock-bottom offer. With higher inventory levels back in late Fall 2023, Buyers were really beginning to feel like they were in the driver’s seat. Naturally then, the return of some bidding wars this Spring has taken some of them by surprise.

So, what can we expect in the months to come? Interest rates, as always, are the metric we need to watch. Last year after a hot spring, the market faded when rates unexpectedly moved higher. This time around, at least in realtor® circles, most are still expecting a pivot toward rate cuts in the coming months which should get the wheels turning faster over the second half of the year. And while affordability conditions remain poor and might make the recovery more of a gradual liftoff, there should also be a lot of pent-up demand to satisfy in the market once confidence returns.

As always, feel free to reach out to any member of our team to help you navigate your own buying and selling decisions.

Learn about closing costs that may impact your bank account

Learn about closing costs that may impact your bank account